by the Night Writer

A few years ago when home values were soaring my wife and I refinanced our house, taking out some equity to remodel part of our main floor while locking in a sub-5% fixed rate, 15-year mortgage (we hate paying interest). This was back in the day when you could finance 125 percent of your equity. The amount we needed was substantially less than this, and our loan officer kept trying to interest us in borrowing more. My wife wasn’t having any of it (I think this might have been the same loan officer who gushed that our credit score “walks on water”). Frankly, it kind of creeped us out to think about taking on all this extra debt simply because we could, especially for intangibles such as travel or ephemerals that depreciate quickly, such as new cars (both of which were examples of things the loan officer suggested we could spend the extra cash on). Fortunately for us, our instincts were correct.

I think most people have an built-in sense, or skepticism, for those “too good to be true” deals, even if we eventually decide that the deal is “too good to pass up.” Then, like the prize trout being reeled in we say, “I knew there was a catch!” It’s hard to resist, though, when the rest of the school is jumping in the boat on their own. Most of us have the scars on our lips to show for it.

I think that’s why so many people are feeling more than a little queasy about the direction of the economy and the proposed borrowing our way to prosperity budget offered by President Obama. How does it make sense that, if we’re in a crisis caused by unchecked borrowing, even more borrowing will get us out? And who are we borrowing from, and what’s the vig? Having learned a few things the hard way we tend to push back a little when the salesman says “you’ve got act by midnight tonight!” At the same time we really want to believe that things aren’t really so bad, and it will all work out in the long-run, because to believe otherwise calls into questions all those nice little assumptions that allow us to sleep at night. So when the salesman tries to allay our concerns with testimonials “Four out of five socialists prefer…” or say that this the “new and improved deficit, now with less rich people” we kind of say, “What the heck, and, you know, I think my next diet will be the one that works, too!”

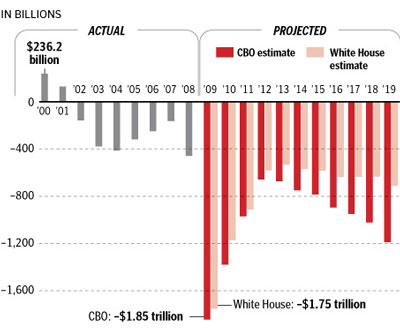

“Besides,” the salesman says, “It’s really not my deficit…I inherited it!” So then we think, “Well, yeah, we’ve always had deficits, Winston, so what’s a little more?” If the Bush administration left us with the equivalent of a budget hangover, perhaps a little hair of the dog makes sense. A picture, as they say, is worth a thousand words — and likely a few trillion dollars as well.

As the Washington Post illustrated the other day:

SOURCE: CBO, White House Office of Management and Budget | The Washington Post – March 21, 2009

That’s not the Republicans providing that chart, or The Center for the American Experiment, or even Joe the Plumber; it’s the Washington Post, using numbers from both the President’s office and the ostensibly non-partisan Congressional Budget Office. As sickening as the Bush fiscal record is (and yes, the numbers above do include money spent on Iraq and Afghanistan), the current administration plans to take a case of the swine flu and turn it into Ebola.

As the Heritage Foundation’s Brian Riedl points out:

- President Bush expanded the federal budget by a historic $700 billion through 2008. President Obama would add another $1 trillion.

- President Bush began a string of expensive financial bailouts. President Obama is accelerating that course.

- President Bush created a Medicare drug entitlement that will cost an estimated $800 billion in its first decade. President Obama has proposed a $634 billion down payment on a new government health care fund.

- President Bush increased federal education spending 58 percent faster than inflation. President Obama would double it.

- President Bush became the first President to spend 3 percent of GDP on federal antipoverty programs. President Obama has already increased this spending by 20 percent.

- President Bush tilted the income tax burden more toward upper-income taxpayers. President Obama would continue that trend.

- President Bush presided over a $2.5 trillion increase in the public debt through 2008. Setting aside 2009 (for which Presidents Bush and Obama share responsibility for an additional $2.6 trillion in public debt), President Obama’s budget would add $4.9 trillion in public debt from the beginning of 2010 through 2016.

Perhaps someone can graph this for me: now that it’s been established that when America sneezes, the rest of the world catches cold, how long before the UN decides that our economy is too important to be left in the hands of Americans and requires global oversight?

HT: Bogus Gold.